A donation is the single most important way you can support our Sixth Form development.

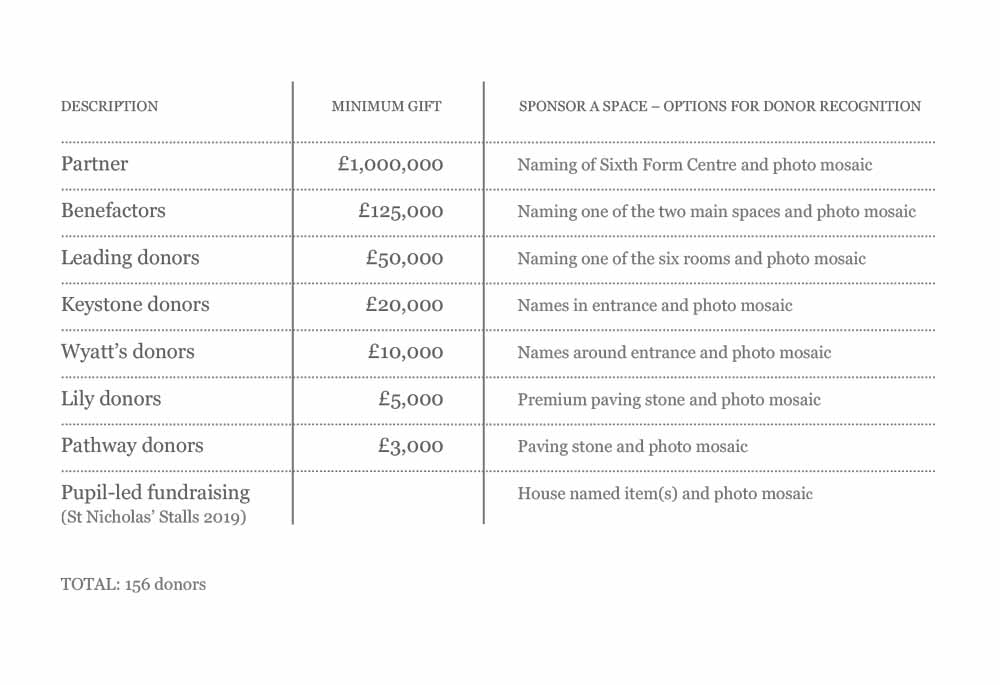

The total cost of the Sixth Form Centre is £2.62m. As with all projects of this size, it is being financed by fundraising and the School borrowing to underwrite the generous pledges. The current pupils and alumnae spearheaded our fundraising campaign through their record-breaking efforts at St Nicholas’ Stalls 2019. We are now approaching the Heathfield community to help support the future of Heathfield’s Sixth Form, and our future in the educational market.

Heathfield does not have an endowment, and fee income is rightly applied to educating and nurturing the pupils of today. We rely on generous support to help us extend opportunities through bursary funding, or to carry out vital developments which enhance the pupils’ experience and keep us ahead of our competitors. Every major facility from which pupils benefit today, such as the Chapel, the sports hall, the swimming pool, the Performing Arts Centre, STEM building, the grand piano and the recording studio, have only been made possible through the generosity of the School community